Think about this - would you open an account with a bank that does not provide online banking? Or use a cab service that expects you to book it a day in advance? What once started as a differentiator is now a normal service that every customer expects.ĪI-based automated, faster, cheaper, and better document processing is a differentiator for mortgage lenders today but it will soon become a commodity.

MORTGAGE OCR TOOL FULL

History is full of precedents of automation and how it changed expectations from customers. Investing in automation technology that is not only compliant but also efficient means long-term cost savings.Īnother important reason to consider automation is that your customers will expect you to reduce your processing costs and times significantly just to keep their business. In this case, the cost increases further by needing to employ a local workforce. Depending on the kind of data you process, it may not be legal to send that data out of the country of origin, especially in the case of data related to loan processing.

MORTGAGE OCR TOOL MANUAL

Cost -Last but not least, having 100% manual data entry teams is expensive.If the processing technology is powered with Artificial Intelligence and machine learning, quality control becomes east, and efficiency knows no bounds. On the other hand, technology for automated data extraction keeps improving continuously. Thereafter, you need to invest a considerable amount in monitoring tools, analytics, and managers to make sure that the efficiency does not go down from that high watermark. As a matter of fact, most data processing operators reach this efficiency within 3 to 6 months, after which. Stagnant Efficiency -There is a relatively low limit on how much efficiency you can get out of a person working for 8 hours to validate extracted data.Replacing and retraining new operators due to such outdated existing processes substantially increases the operational cost of business. When a data entry operator walks out of these operations, the knowledge that he/she has accumulated walks out the door. As a result, there is a lot of churn in these jobs.

We are going through such a time right now. Hence, you are left with surplus talent that you need to lay off.

Scaling down for slower times -When mortgage rates go up and you see a dip in your document processing volumes, as well as overall mortgage processing.There is a significant opportunity cost associated with scaling these teams. Scaling up for higher volumes -When your business goes through a spike in volume, it is generally difficult for these vendors to find people and train them quickly for processing supporting documents to keep up with the demand, more so when the document type varies widely.Using these vendor teams can result in the following challenges:

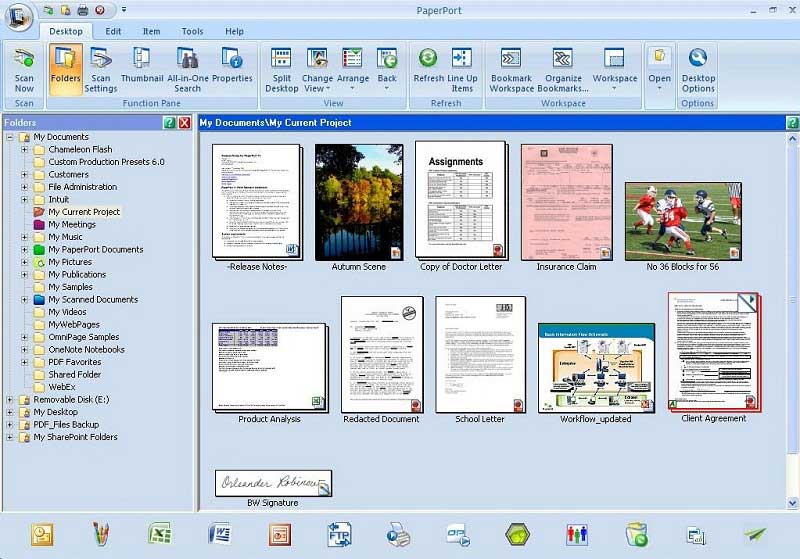

MORTGAGE OCR TOOL SOFTWARE

Many mortgage providers today use a vendor that employs a team of data entry operators who read and enter data from mortgage documents into a Loan Origination Software (LOS). Investing in the automated mortgage processes with technology solutions - Pros and ConsĪ: This is the question that we get asked the most. Q: Working with outsourced vendor partners for manual processes vs. In this blog series, we answer these common questions and make the case for Intelligent Document Processing (IDP) solutions. These seem to be the common concerns among mortgage providers who have not had a good experience with using OCR for mortgage documents or have felt let down with the accuracy of automated processing. Through these conversations, we discovered quite a few repetitive questions.

Our announcement generated a lot of interest from mortgage providers of all sizes and led to a number of interesting conversations. Recently, Infrrd launched Infrrd for Mortgage, an AI-led intelligent document processing (IDP) solution specifically designed for the mortgage industry.

0 kommentar(er)

0 kommentar(er)